How Japan is Driving BESS Investment

A Growing Need for Energy Storage

The increasing generation of renewables on the Japanese grid has led to various support policies and CAPEX subsidy schemes to support the deployment of grid-scale Battery Energy Storage (BESS). In 2021, Japan’s 6th Strategic Energy Plan, followed by the Green Transformation Act in 2023, highlighting its commitment to reaching Net Zero by 2050. These initiatives aim to achieve this through increasing renewable generation and its “S+3E principles” (Safety, Energy Security, Environment and Economic Efficiency). Under the plan, renewables should account for 36-38% of power supplies in 2030.

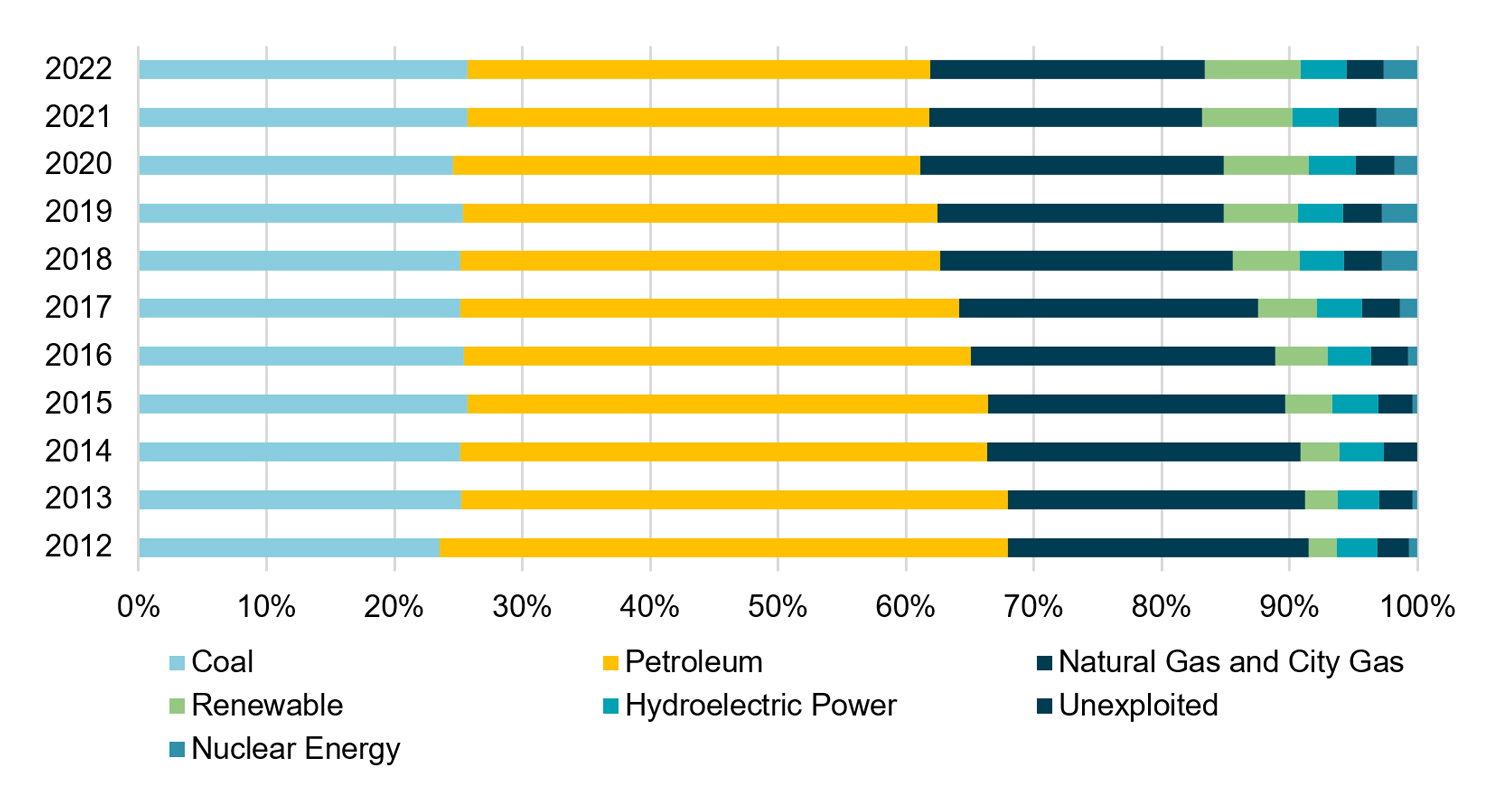

Figure 1: Domestic Primary Energy Supply Source: METI

Figure 1 highlights the growing penetration of renewables over the last decade in Japan’s primary energy supply. Multiple support policies have driven this, such as Feed-in-Premium auctions, which allow renewable generators to sell electricity in the spot market at a premium to wholesale prices. Other support mechanisms include Non-Fossil Certificates and updated curtailment rules.

Increased generation of renewables requires various forms of energy storage to manage the issues associated with intermittency. Japan has, therefore, introduced two CAPEX subsidy schemes for grid-scale battery developers, excluding co-located projects. These are the Ministry of Economy, Trade, and Industry (METI) and the Tokyo prefectural subsidies. There are a series of requirements to be eligible: projects must have a minimum capacity of 1 MW, the battery must be able to participate in various markets, and the battery must be directly connected to the grid.

The Market for Energy Storage

Energy storage in Japan consists of thermal storage, hydro, pumped hydro, and Battery Energy Storage Systems. As Japan works to increase renewable penetration to meet its Net Zero targets, grid balancing becomes more critical to ensure grid stability and replace the inertia typically generated by thermal generators.

The Japanese market is divided into ten utility regions: Hokkaido, Tohoku, Tokyo, Hokuriku, Chubu, Kansai, Chugoku, Shikoku, Kyushu, and Okinawa. The grid operates at 60Hz from Nagano and Shizuoka westwards and 50Hz from Tokyo eastwards.

Figure 2: Map of Japan with the ten utility regions annotated

Five major organisations regulate and determine the future evolution of the Japanese electricity market. These are:

- The Japan Electric Power Exchange (JEPX): manages the wholesale market.

- The Organisation for Cross-regional Coordination of Transmission Operators (OCCTO): coordinates electricity supply and demand plans, manages interconnectors, and runs the capacity market.

- The Ministry of Economy, Trade, and Industry (METI): primarily responsible for the evolution of Japan’s energy policy.

- The Agency for Natural Resources and Energy (ANRE): a department within METI that drafts energy policies.

- The Electricity and Gas Market Surveillance Commission (EGMSC) provides regulatory oversight.

Available Revenue Streams for Grid-Scale Battery Energy Storage Systems in Japan

BESS can generate revenue through the wholesale, capacity, and balancing markets, similar to those seen in Great Britain (GB). Currently, the proportion of total revenue from each service mirrors that seen in GB. As new balancing market products have been introduced this year, the breakdown of revenue per market is expected to vary as these products become more established.

Merchant Revenue Streams

Japan is divided into ten zones, with JEPX covering 9 of these, with the exception of Okinawa, as this zone does not have an interconnector to the other mainland zones. Prices diverge between regions due to limited interconnection and different regions having different supply mixes.

The wholesale market is not mandatory but is increasingly relevant for BESS. JEPX markets include day-ahead (30-minute windows for the next-day delivery), intra-day, and forward market.

Additionally, the balancing market, known as the “supply and demand adjustment market,” pays participants able to help balance supply and demand after the gate closures of the wholesale market. The balancing market has undergone significant reform with the introduction of new products this year, all currently operational.

Three new products have also been introduced in 2024, designed to tackle the system’s distinct balancing requirements (Primary, Secondary-1, Secondary-2). This brings the total number of balancing products to five with the already existing Tertiary-1 and Tertiary-2 products. They broadly vary due to their response time, with Primary having the shortest response time of within 10 seconds up to Tertiary-2, requiring a response over 30 minutes. BESS can participate in multiple of these products simultaneously.

Contracted Revenue Streams

The capacity market provides payments to secure reserve capacity sufficient to cover anticipated peak demand, mirroring the GB market with T-1 and T-4 auctions. Whilst the price can vary by region, a nationwide price ceiling equal to 150% of the Net Cost of New Entry (NetCONE) applies.

Japan has also introduced a long-term decarbonisation auction; these are fixed-priced 20-year contracts, with bidding ceilings varying by region. The auction is designed to promote investment in large-scale power generation projects for decarbonisation with a procurement target of 1 GW per annum across BESS and pumped hydro assets. BESS must have a minimum capacity of 10 MW and a 3-hour duration to qualify. However, the proposal for the second round requires a minimum of 30 MW and higher prices for longer-duration assets (6 hours+). Under the program, participants can bid for fixed cost recovery at 5% WACC while also subject to a 90% profit return mechanism.

Gore Street in Japan

Gore Street Capital and ITOCHU Corporation have been selected by the Tokyo Metropolitan Government (TMG) to manage Japan’s first fund dedicated to grid-scale energy storage. The two firms have been jointly selected as the managers of TMG’s energy creation and energy storage promotion fund following a competitive process held in April 2023. The fund will be targeted at projects in the Kanto region of Japan. TMG intends for the energy storage assets to support its efforts to expand renewable electricity usage to 50% by 2030. More information can be found here.

Conclusion

Japan’s pursuit of its Net Zero target by 2050 underscores the critical need for energy storage solutions to support the growing penetration of renewable energy. With the government’s policies, such as the 6th Strategic Energy Plan and the Green Transformation Act, the emphasis on renewable energy is clear, but so is the challenge of managing intermittency and grid stability. As a result, energy storage systems, particularly BESS, have become essential to maintaining a balanced and reliable grid. Japan’s development of revenue streams through its wholesale, capacity, and balancing markets, coupled with CAPEX subsidy schemes for grid-scale battery projects, provides a framework to encourage investment in energy storage. As renewable energy continues to increase its share in the power generation mix, the role of energy storage will only become more vital in ensuring the success of Japan’s clean energy transition.